Korea Pay TV subscribers grew in 0s% for the first time in 2023(작년 유료방송 가입자, 첫 0%대 증가 기록)

작년 유료방송 가입자, 첫 0%대 증가율 기록

South Korea Pay TV subscriber growth rate hit zero percent year-on-year for the first time last year, according to a new report.

This is the first time since the Korean Pay TV market has been centered on cable TV, satellite broadcasting, and IPTV since the introduction of IPTV (Internet TV) services in 2009. It has been pointed out that the number of paid broadcast subscribers is declining due to the rise of streaming service such as Netflix.

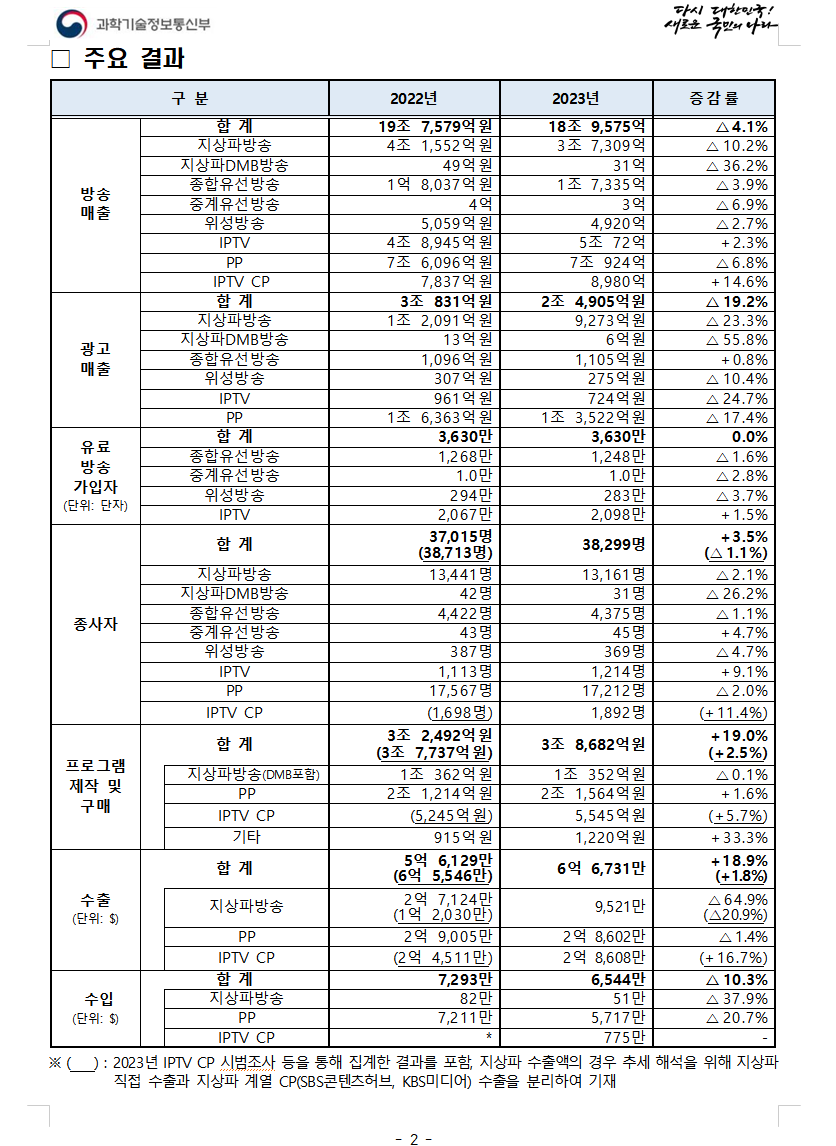

| Category | 2022 | 2023 | Change Rate |

|---|---|---|---|

| Broadcasting Revenue | |||

| Total | 19.7579 trillion won | 18.9575 trillion won | -4.1% |

| Terrestrial Broadcasting | 4.1552 trillion won | 3.7309 trillion won | -10.2% |

| Terrestrial DMB Broadcasting | 4.9 billion won | 3.1 billion won | -36.2% |

| Cable TV | 1.8037 trillion won | 1.7335 trillion won | -3.9% |

| Relay Cable Broadcasting | 400 million won | 300 million won | -6.9% |

| Satellite Broadcasting | 505.9 billion won | 492 billion won | -2.7% |

| IPTV | 4.8945 trillion won | 5.0072 trillion won | +2.3% |

| PP | 7.6096 trillion won | 7.0924 trillion won | -6.8% |

| IPTV CP | 783.7 billion won | 898 billion won | +14.6% |

| Advertising Revenue | |||

| Total | 3.0831 trillion won | 2.4905 trillion won | -19.2% |

| Terrestrial Broadcasting | 1.2091 trillion won | 927.3 billion won | -23.3% |

| Terrestrial DMB Broadcasting | 1.3 billion won | 600 million won | -55.8% |

| Cable TV | 109.6 billion won | 110.5 billion won | +0.8% |

| Satellite Broadcasting | 30.7 billion won | 27.5 billion won | -10.4% |

| IPTV | 96.1 billion won | 72.4 billion won | -24.7% |

| PP | 1.6363 trillion won | 1.3522 trillion won | -17.4% |

| Pay TV Subscribers (units) | |||

| Total | 36.30 million | 36.30 million | 0.0% |

| Cable TV | 12.68 million | 12.48 million | -1.6% |

| Relay Cable Broadcasting | 10,000 | 10,000 | -2.8% |

| Satellite Broadcasting | 2.94 million | 2.83 million | -3.7% |

| IPTV | 20.67 million | 20.98 million | +1.5% |

| Employees | |||

| Total | 37,015 (38,713) | 38,299 | +3.5% (-1.1%) |

| Terrestrial Broadcasting | 13,441 | 13,161 | -2.1% |

| Terrestrial DMB Broadcasting | 42 | 31 | -26.2% |

| Cable TV | 4,422 | 4,375 | -1.1% |

| Relay Cable Broadcasting | 43 | 45 | +4.7% |

| Satellite Broadcasting | 387 | 369 | -4.7% |

| IPTV | 1,113 | 1,214 | +9.1% |

| PP | 17,567 | 17,212 | -2.0% |

| IPTV CP | (1,698) | 1,892 | (+11.4%) |

| Program Production and Purchase | |||

| Total | 3.2492 trillion won (3.7737 trillion won) | 3.8682 trillion won | +19.0% (+2.5%) |

| Terrestrial Broadcasting (incl. DMB) | 1.0362 trillion won | 1.0352 trillion won | -0.1% |

| PP | 2.1214 trillion won | 2.1564 trillion won | +1.6% |

| IPTV CP | (524.5 billion won) | 554.5 billion won | (+5.7%) |

| Others | 91.5 billion won | 122 billion won | +33.3% |

| Exports (USD) | |||

| Total | $561.29 million ($655.46 million) | $667.31 million | +18.9% (+1.8%) |

| Terrestrial Broadcasting | $271.24 million ($120.30 million) | $95.21 million | -64.9% (-20.9%) |

| PP | $290.05 million | $286.02 million | -1.4% |

| IPTV CP | ($245.11 million) | $286.08 million | (+16.7%) |

| Imports (USD) | |||

| Total | $72.93 million | $65.44 million | -10.3% |

| Terrestrial Broadcasting | $0.82 million | $0.51 million | -37.9% |

| PP | $72.11 million | $57.17 million | -20.7% |

| IPTV CP | * | $7.75 million | - |

According to the '2023 Broadcasting Industry Survey' released by the Ministry of Science and ICT and the Korea Communications Commission on December 25, the number of paid broadcasting subscribers in Korea stood at 36.3 million (line-based) as of December last year, an increase of only about 3,000 year-on-year.

In detail, the number of cable TV subscribers decreased by 1.6% year-on-year to 12.48 million, and satellite broadcast subscribers decreased by 3.7% year-on-year to 2.83 million. Although IPTV subscriptions increased to 20.98 million, the growth rate was only 1.5%.

At the end of 2009, the number of paid broadcast subscribers in Korea was growing at a 13% year-on-year rate, but as the market became more saturated and OTTs such as Netflix gained traction in the mid-2010s, the growth rate of paid broadcast subscribers slowed down. In 2018, the growth rate of paid broadcast subscribers dropped to 3.5%, and in 2022, the growth rate of paid broadcast subscribers dropped to 1.5% due to the impact of OTT, which grew rapidly during the coronavirus pandemic.

The Broadcasting Industry Survey, which has been conducted since 2000, is a state-approved statistical survey that is released by the government in June of each year after receiving data on the previous year from broadcasting companies with broadcasting revenues of more than 100 million won, and further analyzed at the end of each year.

국내 유료 방송 시장의 가입자 증가율이 IPTV(인터넷TV) 도입 이후 처음으로 0%대를 기록한 것으로 나타났다. 이는 2009년 IPTV 서비스가 본격 등장하면서 케이블TV·위성방송·IPTV가 주축을 이뤄온 유료 방송 시장이 사실상 정체기에 접어들었음을 시사한다.

특히 넷플릭스 등 OTT(온라인 동영상 서비스) 이용자가 빠르게 늘면서 유료 방송 가입자의 증가 폭이 크게 줄어든 것으로 분석된다.

과학기술정보통신부와 방송통신위원회가 25일 발표한 ‘2023년 방송 산업 실태 조사’에 따르면, 지난해 12월 기준 국내 유료 방송 가입자는 3,630만 명(회선 기준)으로 집계됐다. 이는 전년 대비 불과 3,000명 늘어난 수준에 그쳤다. 유형별로 보면, 케이블TV 가입자는 전년보다 1.6% 감소한 1,248만 명, 위성방송 가입자는 3.7% 줄어든 283만 명으로 집계됐다. IPTV 가입자는 2,098만 명으로 소폭 늘었지만 증가율은 1.5%에 머물렀다.

유료 방송 가입자 증가율은 2009년 말만 해도 전년 대비 13%에 이를 만큼 가파른 상승세를 보였으나, 이후 시장 포화와 더불어 2010년대 중반부터 넷플릭스 등 OTT 플랫폼이 급성장하면서 증가 폭이 눈에 띄게 줄었다. 이에 2018년 유료 방송 가입자 증가율은 3.5%로 낮아졌고, 코로나19 시기를 거치며 OTT가 더욱 확산되자 2022년에는 1.5%까지 떨어졌다.

한편, ‘방송 산업 실태 조사’는 국가 승인 통계조사로, 정부가 매년 6월쯤 방송 매출 1억 원 이상 사업자들을 대상으로 전년 자료를 취합한 뒤 분석해 연말에 발표하는 제도다.

![[보고서]디즈니의 IP 플라이휠, 1957년 메모에서 시작된 100년 전략](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/vtekpo_202512140501.png)

![[리포트]글로벌 스트리밍 대전환과 FAST 시장의 부상](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/7jw8up_202512120304.png)

![[보고서]K-콘텐츠, 몰입형 공간 새로운 경험](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/12/je15hi_202512061434.png)

![[K콘텐츠와 K FAST]](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/11/zxwbgb_202511241038.jpg)

![[모집]1월 9일~14일 글로벌 AI 스템 캠프(자료집)](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/11/3kf0x5_202511031830.png)

![[MIPCOM2025]글로벌 엔터테인먼트 트렌드](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/10/duxlsp_202510170000.png)

![[보고서]생성AI와 애니메이션](https://cdn.media.bluedot.so/bluedot.kentertechhub/2025/09/c49fxu_202509271057.png)